Case Study

Organizational Efficiency: How a Credit Union Transformed Productivity and Enhanced the Member Experience

Nature of engagement:

Channel Optimization

Assets:

$3.5B

Members:

188,000

Headquarters:

The Southeast

Branches:

30+

The credit union sought to restructure its organization to align with market changes and improve financial performance while enhancing the member experience.

Background

Credit unions looking to differentiate their brand and achieve financial stability and growth must prioritize organizational efficiency to deliver enhanced member experiences.

Despite an expected 20% decline in all branch-based financial transactions by 2026,* many consumers prioritize proximity to a physical location when selecting their primary financial institution. Businesses also consider a conveniently located branch to be preferable, due to the continual need for access to coin and currency.

Today's banking experience finds the role of the branch witnessing an ongoing evolution, posing a significant challenge for credit union executives determined to deliver meaningful member experiences.

One such credit union, an institution with over $3.5B in assets, 30+ branches, and serving more than 188,000 members, sought to restructure its organization to align with market changes and to improve its financial performance while also enhancing the member experience.

Solution

The credit union selected Engage fi to conduct an organizational efficiency analysis based on the consulting firm's knowledge of the credit union space. Unlike large, non-industry-specific advisory firms, Engage fi develops tailored solutions that leverage a credit union's member data, while also aligning with its core mission, vision, values, and culture. Having established a results-based partnership throughout multiple projects, Engage fi met the credit union's requirements.

Engage fi initiated the project by conducting a comprehensive analysis of the credit union's operational structure, ensuring alignment with key objectives. Data analysis found that only 23% of branch employees were being fully utilized, based on in-branch traffic. On average, the contact center experienced 4,000 overflow calls per month, leading to a 15% abandonment rate, an average of 5.5 minutes per call, and a wait time of a little more than seven and a half minutes. It was also determined that the member account originating process and workflow varied significantly by channel.

Engage fi discovered a $6.5 million shortfall that must be closed for the credit union to reach the peer group median in key performance indicators (KPIs). Achieving this objective would require a substantial increase in net operating income.

Results

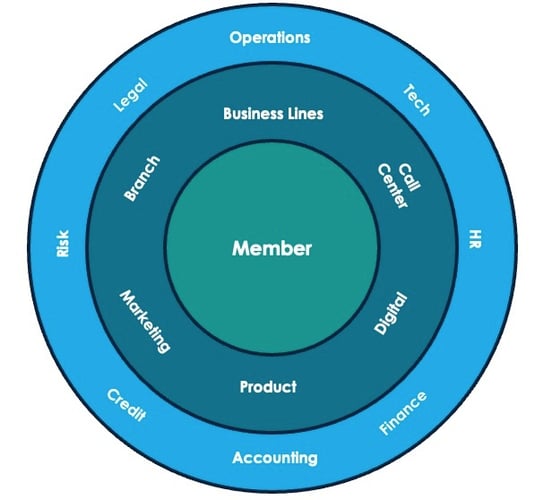

Engage fi recommended the credit union move to a member-centric organization model that would result in a $l2M improvement to its net operating income. To note: a typical credit union's business model organizes it around business lines, departments, and delivery channel verticals. The new model [developed by Engage fi] organized the credit union based on the actions of its members. Now, the organizational structure would not only improve efficiencies, but also it would increase the quality of the member experience.

The analysis of channel utilization and member-centric reorganization classified branches into different groups, enabling more efficient workload distribution across all delivery channels. As a result, branch full-time employee utilization increased from 23% to 59%. Additionally, new member engagement opportunities were identified, creating potential for increased revenue through enhanced member cross-sell. Once the model is fully implemented, a follow-up assessment in 2026 will evaluate its impact and determine if further operational adjustments are needed.

The organizational efficiency analysis has proven to be transformative, improving employee utilization while uncovering new revenue streams. Through this initiative, the credit union is positioned for sustainable growth and enhanced member engagement, while also surpassing peer median financial performance.

*BAI March 2024

Organizational Efficiency Results

Improvement to Net Operating Income

Full-Time Employee Utilization

Streamline Operations and Enhance the Customer/Member Experience

Lorem ipsum dolor

Lorem ipsum dolor sit amet