The Benefits of Offering an Integrated Peer-to-Peer Service Through a Digital Banking Platform

By Greg Ryan

Navigate this high stakes process with precision.

A solution delivering fast, efficient, and accurate core data.

Digital solutions to grow, scale, and outperform.

Reliable, efficient, and integrated core platforms deliver results.

Select modern communications channels to integrate with core and digital solutions.

Strategic Planning

Support services for the strategic planning process at every level.

M&A Planning

Realize the key value drivers resulting from your merger or acquisition.

Performance Benchmarking

Tailored metrics and benchmarks designed to assess relationships.

Organizational Efficiency

Enhance efficiency across branches, digital channels, and contact centers.

A digital library of industry news, analysis, best practices, and thought leadership tailored to the challenges and opportunities faced by financial institutions.

Our in-depth analysis of conversion strategies, M&A activity, and the evolving landscape of financial services.

A podcast channel for the time-constrained banking professional delivering sharp insights on fintech, strategy, and leadership to help you stay ahead in a fast-changing financial world.

For 360fi Workflow clients only. Sign in to access the workflow library and other guides, forms, and tutorials.

2 min read

Marketing

:

Jan 26, 2021 3:56:24 AM

Marketing

:

Jan 26, 2021 3:56:24 AM

TAMPA, Fla., Jan 19, 2021 — Trellance, the leading provider of data analytics, business intelligence and professional services to community-based financial services organizations, today announced a professional services partnership with Engage fi, a national consultancy that delivers vendor and technology evaluations as well as project management services to credit unions.

As credit unions need trusted advisors to evaluate and negotiate with providers of financial solutions or services like digital banking and card processing, Trellance will refer organizations to Engage fi. The resulting commercial partnership makes it easier for credit unions to select or work with two industry-leading providers whose services align with the initiatives credit unions are actively pursuing today.

“Credit unions and other financial institutions are increasingly using data-driven insights to run their operations,” shared Trellance Chief Product Officer, Paolo Teotino. “This new partnership with Engage fi brings data initiatives and vendor selection closer together, helping organizations execute faster on many of the enterprise projects that lead to organizational growth and improved member experience. Trellance continues to put actionable insights into the hands of credit unions, and we are excited to partner with Engage fi.”

Under the terms of the new partnership, Trellance adds Engage fi to its growing list of referral, data services and solution extension partners in the Trellance Partner Program. The program, created to provide a network of applications to support credit unions and their digital transformation journey, has more than doubled its participants in the second half of 2020. Today, the partnership ecosystem includes industry-leading organizations and provides a coalition of solutions that enhance the Trellance M360 data analytics platform, increase member value and improve operational efficiencies for community financial institutions.

“Credit union executives are pressed for time but need to continually ensure they are providing the latest services for their members at the right price,” shared Jennifer Addabbo, CEO of Engage fi. “As we work with clients during engagements, they are increasingly looking for a stronger connection between the upfront provider evaluation and the resulting digital technologies they need. The Trellance partnership allows us to work with Trellance customers who are ready to successfully execute new projects as part of their strategic plan.”

As credit unions take data-driven approaches to vendor evaluations and commercial negotiations, they achieve greater results. Mark Zook, CEO of Maps Credit Union and joint Trellance and Engage fi client, adds, “Data wins. And a partnership that combines two credit union organizations who are focused on credit union growth also wins. I’m excited to see the partnership between Trellance and Engage fi produce new benefits.”

To learn more about data-led insights and how financial intuitions are benefiting from the next generation of software solutions, visit the Trellance website at www.trellance.com. More information about the provider evaluation and selection process mentioned in this release can be found on the Engage fi website: engagefi.bssdev.com

The team at Engage fi is a blend of consultants, educators, matchmakers, integrators and advocates. The only credit union consultancy recognized by INC, we are laser-focused on guiding our credit union clients through our proven process and enabling them to make informed, timely decisions on vendor relationships so they can change at the speed of the consumer. Engage fi has completed over 410 credit union projects and negotiated over 2 Billion in savings and incentives for our clients and our projects are as unique as the clients we serve. Let’s Engage! engagefi.bssdev.com

Trellance is the leading provider of data and business intelligence solutions for credit unions and community banks. The company’s solutions and services, together with the patented common data model of its signature M360 product, are used by financial institutions to find actionable insights, improve customer experience and achieve portfolio growth. Founded in 1989, Trellance is headquartered in Tampa, Fla. and serves more than 1,500 organizations throughout the United States.

By Greg Ryan

Virginia Heyburn

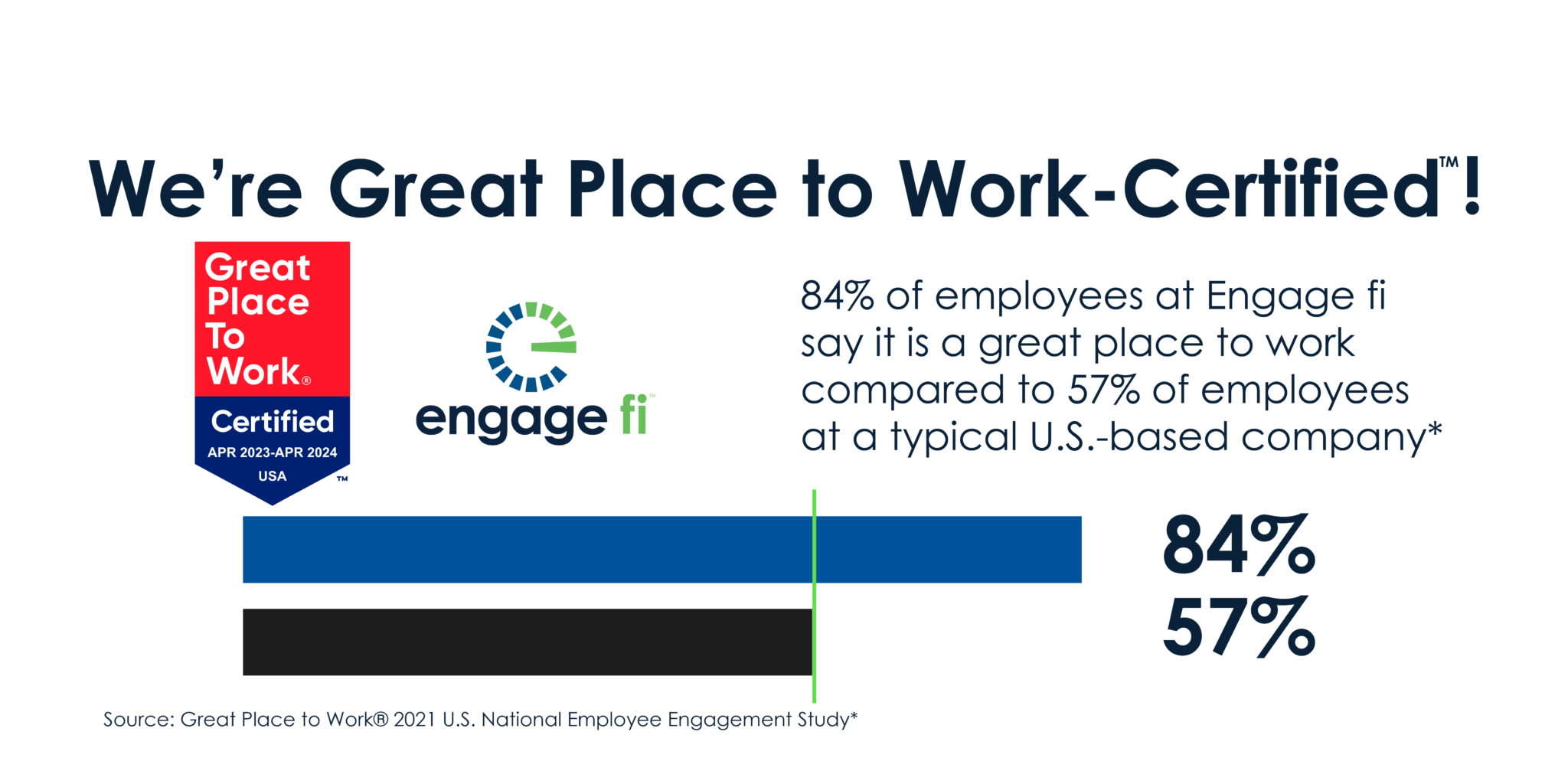

Tampa, FL – May 10, 2023 – Engage fi is proud to be Certified™ by Great Place to Work® for 2023. The prestigious award is based entirely on what...