Bill Pay Keeps Your Financial Institution Top of Wallet

Bill Pay Keeps Your Credit Union Top of Wallet and Top of Mind with Millennial and Gen Z Consumers Making up 55% of the U.S. population, millennial...

Navigate this high stakes process with precision.

A solution delivering fast, efficient, and accurate core data.

Digital solutions to grow, scale, and outperform.

Reliable, efficient, and integrated core platforms deliver results.

Select modern communications channels to integrate with core and digital solutions.

Strategic Planning

Support services for the strategic planning process at every level.

M&A Planning

Realize the key value drivers resulting from your merger or acquisition.

Performance Benchmarking

Tailored metrics and benchmarks designed to assess relationships.

Organizational Efficiency

Enhance efficiency across branches, digital channels, and contact centers.

A digital library of industry news, analysis, best practices, and thought leadership tailored to the challenges and opportunities faced by financial institutions.

Our in-depth analysis of conversion strategies, M&A activity, and the evolving landscape of financial services.

A podcast channel for the time-constrained banking professional delivering sharp insights on fintech, strategy, and leadership to help you stay ahead in a fast-changing financial world.

For 360fi Workflow clients only. Sign in to access the workflow library and other guides, forms, and tutorials.

4 min read

Engage fi team

:

Aug 16, 2022 5:44:50 PM

Engage fi team

:

Aug 16, 2022 5:44:50 PM

By Megan Cummins | Strategic Consultant |

“Oh no, not another article on Buy Now Pay Later (BNPL),” might be your thought right now. Or, if you are like me, “YES! More data on BNPL!” Because the truth is, BNPL is so new that beyond a few research studies, we are just now starting to analyze the actual data from BNPL and its impact on consumers. The Consumer Financial Protection Bureau (CFPB) has a hunch, and it will soon have a lot to say about regulations, but in the meantime, here is what we do know:

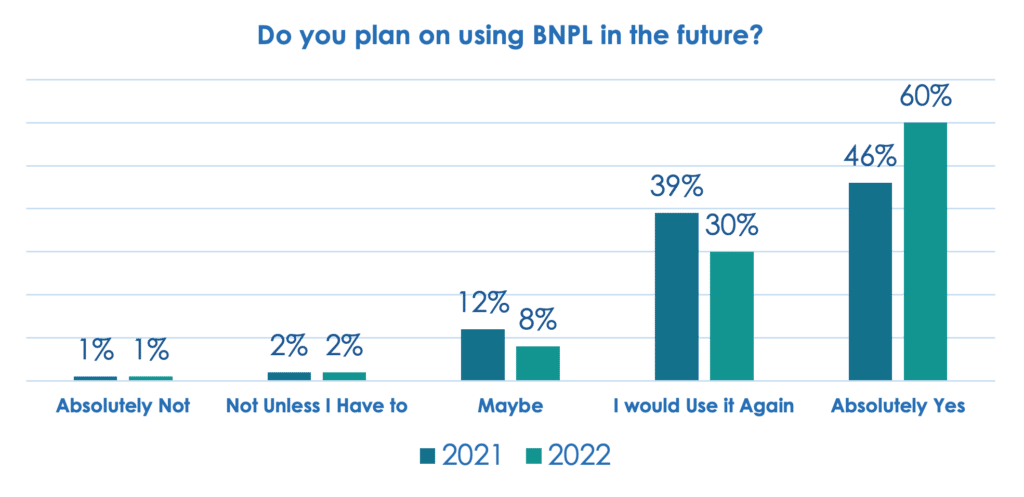

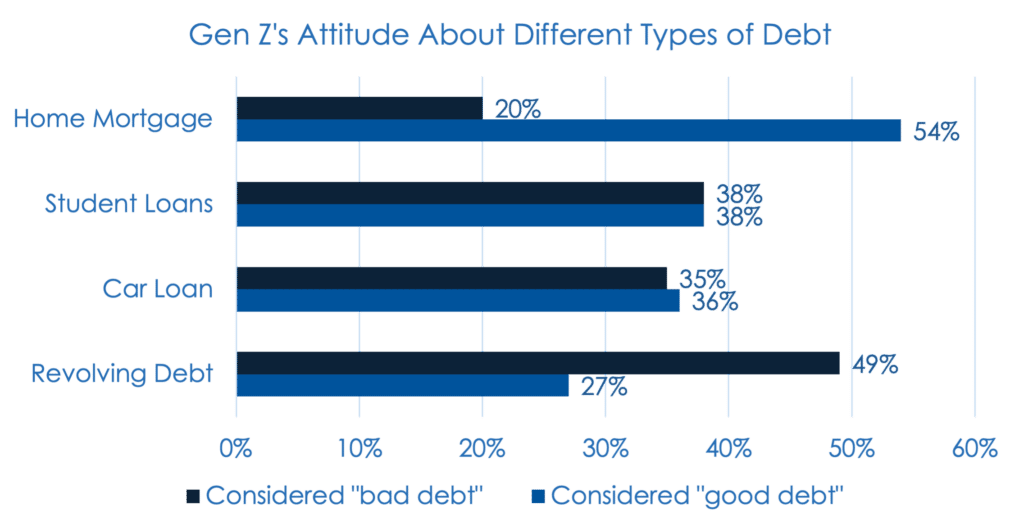

Over half of the population has tried BNPL, and consumer brand awareness of providers is very high across all demographics. Seventy-five percent of BNPL transactions come from the youngest demographic and most who have tried it plan on using it again, even if they have missed a payment.

Source: “Buy Now Pay Later, An Analysis of Key Trends and Consumer Attitudes Part 2”. SG April 2022

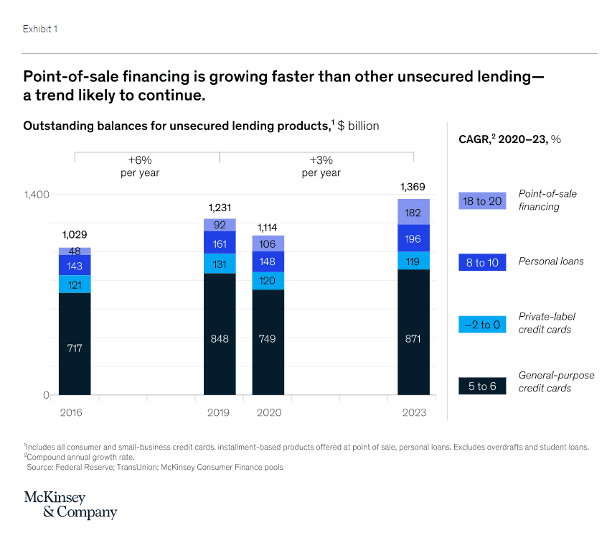

What’s at stake for financial institutions?

Source: TSG ‘Buy Now, Pay Later: An Analysis of Key Trends and Consumer Attitudes: Part 2’ April 2022

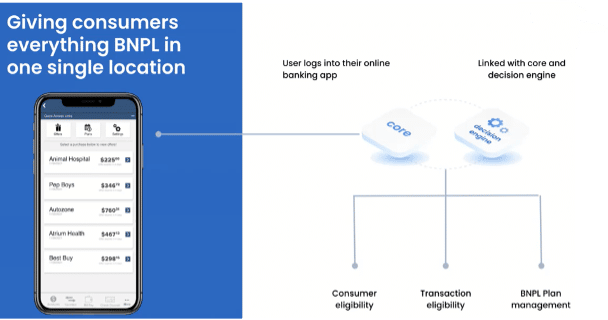

If you haven’t started discussing BNPL within your institution, you must do so now. Most financial institutions will not be able to develop their own solutions internally because of limitations with staff and the current technical infrastructure. In our latest webinar at Engage fi, we featured three vendors who have solutions to help you bring a BNPL product to life.

Vendors Enabling BNPL

These three companies offer different solutions to financial institutions competing in the BNPL space. While PSCU’s solution works with existing credit cardholders to increase balances on their lines of credit, equipifi works with existing debit cardholders to increase interchange and net new interest income through new loans within the debit card portfolio. Quilo, on the other hand, enables financial institutions to increase and establish new personal loan balances and will be relevant to those who want to increase their offerings around small businesses.

Many other solutions are available to your financial institution, but before you decide what next steps your financial institution will take, it’s important to identify the gaps you want to fill. For example, do you want to increase your small business offerings? Are you focused on loan growth? Are you focused on attracting a younger customer base? Answering these questions will help to ensure you make the right decision for your financial institution.

Final Thoughts

One step we all need to take is to offer financial wellness and education on the BNPL topic. Don’t forget why BNPL gained popularity in the first place: it was easy for the consumer. It’s time financial institutions take the next step in offering easy, responsible BNPL solutions to their own consumers. There’s too much to lose.

Megan Cummins is passionate about helping her clients achieve sustainable growth. She has spent the last 10 years of her career advising financial institutions on all facets of strategic thinking and planning. She analyzes and interprets data and financials to provide insights and actionable recommendations to help financial performance. “You can never have enough data” is one of her mantras. As a Strategic Consultant for Engage fi, Megan will help credit unions and banks increase efficiency and reach their strategic goals.

Engage fi has saved its clients over $2.5 billion in savings and incentives. To learn more about how Engage fi can help your financial institution, visit www.engagefi.com

Bill Pay Keeps Your Credit Union Top of Wallet and Top of Mind with Millennial and Gen Z Consumers Making up 55% of the U.S. population, millennial...

Not too long ago, online banking was still considered an add-on service to physical locations. But we have reached the point with many customers...

Gen Z does not have much interest in traditional banking. They were grandfathered into their families’ brick-and-mortar personal bank, and banking...