Embedded Fintech or Embedded Finance? Essential Strategies to Future-Proof Your Financial Institution

Virginia Heyburn

Navigate this high stakes process with precision.

A solution delivering fast, efficient, and accurate core data.

Digital solutions to grow, scale, and outperform.

Reliable, efficient, and integrated core platforms deliver results.

Select modern communications channels to integrate with core and digital solutions.

Strategic Planning

Support services for the strategic planning process at every level.

M&A Planning

Realize the key value drivers resulting from your merger or acquisition.

Performance Benchmarking

Tailored metrics and benchmarks designed to assess relationships.

Organizational Efficiency

Enhance efficiency across branches, digital channels, and contact centers.

A digital library of industry news, analysis, best practices, and thought leadership tailored to the challenges and opportunities faced by financial institutions.

Our in-depth analysis of conversion strategies, M&A activity, and the evolving landscape of financial services.

A podcast channel for the time-constrained banking professional delivering sharp insights on fintech, strategy, and leadership to help you stay ahead in a fast-changing financial world.

For 360fi Workflow clients only. Sign in to access the workflow library and other guides, forms, and tutorials.

5 min read

Marketing

:

Jan 26, 2023 4:59:25 AM

Marketing

:

Jan 26, 2023 4:59:25 AM

Kellie Lowder

Senior Advisor

Engage fi (Formerly CU Engage)

Whether a consumer opens their web browser or turns on a TV show, they will be exposed to countless commercials for insurance. The days of shopping through two or three local agencies for your insurance needs are long gone. Beyond traditional big-brand carriers, consumers can obtain quotes through national banks, auto dealerships, multi-carrier online portals, and even Walmart. These entities do extensive research and allocate significant marketing dollars to reach consumers at the perfect moment. While the competition is never-ending, there is a wonderful opportunity for credit unions and community banks to enter this market and be successful.

Many financial institutions see an in-house insurance agency as a natural extension of their core business, providing a steady stream of non-interest income and serving the financial needs of their customers. According to PYMNTS, a quarter of consumers said they would buy life insurance from their banks. About 50 percent of those with life insurance products said they’d purchase other financial products from their financial institutions. This indicates excellent potential for an in-house insurance agency, provided you have the right strategy in place. When done correctly, there are several significant benefits for the financial institution and the customer.

Credit unions and community banks frequently look for ways to enhance customer relationships and increase share of wallet. Insurance can be the next step to offering a full suite of financial services while having a positive impact on your financial institution’s bottom line. During the process of evaluating this new line of business, there are a few important considerations to include.

Every customer who finances a home or a car, rents an apartment, grows their family, or starts a business, will need insurance. As their financial partner, you are privy to many of these events, and you possess a wealth of data to seize on opportunities. Securing insurance is a need for all customers; why not address those needs through the financial institution they already know and trust?

Financial institutions should assess how much time and resources they want to spend educating themselves and building the business needed to get an agency off the ground and on the path to profitability. When considering adding insurance services, there are three general models to create an in-house agency.

Even though there are many self-serve options for consumers, there is a real advantage to having an agent operate as a trusted advisor. A recent survey by Agentero reported that 64 percent of millennials and 54 percent of Generation Z consumers say they still plan to use an insurance agent. Older consumers were much more likely to say they trust their agents, with 79 percent of baby boomers, 67 percent of Generation X, and 74 percent of millennials stating they trust their insurance agent “usually” or “always.” Insurance coverage is complicated, and this direct consultation can take the stress out of purchasing a policy.

For financial institutions, there is significant value in delivering a great experience from end to end, but it must be done correctly. There are several key considerations during this process.

There are many options your financial institution should consider when evaluating the addition of an insurance agency to your offering. The path you decide on can significantly impact the outcome of your efforts. Following an assessment of your objectives and business goals, a consultant with experience and knowledge of your industry can help you create the right strategy and long-term business model to build your in-house agency.

Kellie Lowder brings almost three decades of experience working with FI’s to help them achieve their goals. Prior to joining Engage fi, Kellie was operating as a partner to our team while growing and managing her own consulting firm. Her passion for insurance comes from working with clients across the US, including as an executive at SWBC for almost 15 years prior to starting her own business. As senior advisor, Kellie works with our team to serve our clients’ insurance needs. She utilizes her expertise to consult with financial institutions as they navigate key insurance decisions and negotiations.

To schedule a time to speak with Kellie or one of our other consultants about your financial institution’s in-house insurance agency strategy, please call us at (844) 415-7962 or click here to book a call online.

Virginia Heyburn

Bill Pay Keeps Your Credit Union Top of Wallet and Top of Mind with Millennial and Gen Z Consumers Making up 55% of the U.S. population, millennial...

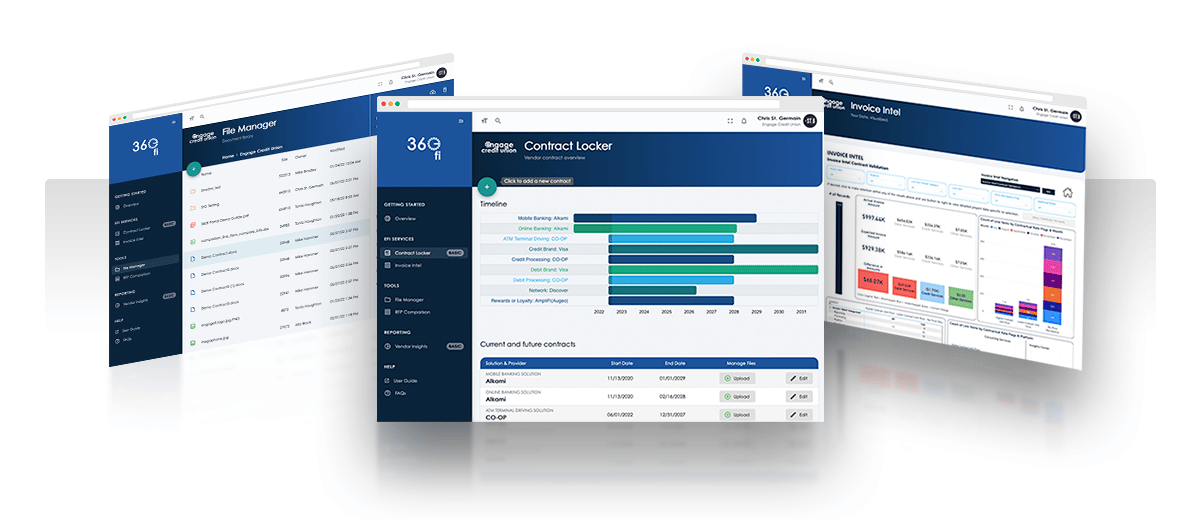

360fi Merges Proven Industry Data and Insights with Innovative Technology Automation to Enable Financial Institutions to Make More Informed Business...