The $10 Billion Question: Why Most Banks Are Sitting on a Data Gold Mine They Can't Spend

Key Takeaways from This Blog:

Navigate this high stakes process with precision.

A solution delivering fast, efficient, and accurate core data.

Digital solutions to grow, scale, and outperform.

Reliable, efficient, and integrated core platforms deliver results.

Select modern communications channels to integrate with core and digital solutions.

Strategic Planning

Support services for the strategic planning process at every level.

M&A Planning

Realize the key value drivers resulting from your merger or acquisition.

Performance Benchmarking

Tailored metrics and benchmarks designed to assess relationships.

Organizational Efficiency

Enhance efficiency across branches, digital channels, and contact centers.

A digital library of industry news, analysis, best practices, and thought leadership tailored to the challenges and opportunities faced by financial institutions.

Our in-depth analysis of conversion strategies, M&A activity, and the evolving landscape of financial services.

A podcast channel for the time-constrained banking professional delivering sharp insights on fintech, strategy, and leadership to help you stay ahead in a fast-changing financial world.

For 360fi Workflow clients only. Sign in to access the workflow library and other guides, forms, and tutorials.

Key Takeaways From This Blog:

Banks and credit unions have spent decades piling up customer and member data across cores, lending systems, digital platforms, and call centers. Every new vendor promises a sharper view, yet the reality often looks more like a junk drawer stuffed with disconnected fragments. CRM was intended to bring order to the chaos, but it quickly became another silo, compounded with clunky workflows and unreliable records.

The CRM market is climbing rapidly. In financial services, spend is projected to reach $18.1 billion in 2025, a 17.8 percent growth rate from the prior year. Forecasts suggest it could more-than-double by 2032. That surge reflects demand across banks and credit unions for sharper engagement, stronger personalization, and fewer manual processes. Still, the tools only pay off if the underlying data is unified, clean, and trusted.

This is where artificial intelligence steps in. AI can connect fractured systems into a real profile of the customer or member. It identifies duplicates, normalizes records, and fills data gaps at a scale humans cannot manage. Forbes recently highlighted how institutions integrating information across more than fifteen systems built deeper profiles that powered sharper interactions. Another study found that 92 percent of early AI adopters are reporting ROI, yet more than half admit their biggest hurdle is data readiness. Those two statistics sit side by side like warning lights: the value is clear, but the pipes are clogged.

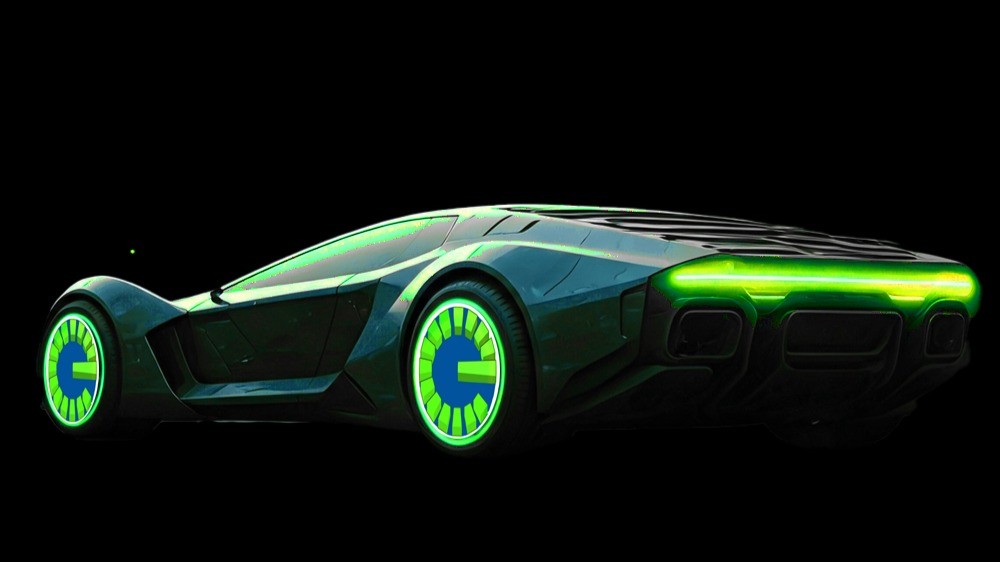

Think of AI as a mechanic working under the hood of CRM. It keeps the engine running by cleaning the fuel and smoothing the system. Without AI, CRM resembles a showroom car that never leaves the lot. It looks sleek but delivers no horsepower. With AI feeding it quality data, CRM becomes more than a system of record. It becomes a system of action, surfacing next best offers, alerting lenders and service teams to signals, and powering engagement across both digital and human channels.

The payoff is not theoretical:

Numbers like this show what is possible when AI and CRM stop working in silos and start operating in tandem.

Yet the human factor remains decisive. CRM adoption fails when frontline staff see it as another accountability and reporting tool. AI adoption fails when teams doubt its accuracy or see it as a threat. Leadership in both banks and credit unions has to treat AI and CRM as cultural projects as much as technology projects. Progress depends on training, role-based workflows, and trust. Quick wins build confidence. Strong executive sponsorship signals commitment.

CRM alone is like owning a high-performance car. AI is the engine that gives it power. But if the data is messy and no one is in the driver’s seat, the car goes nowhere. Clean, connected data and daily adoption turn CRM and AI from a showpiece into a growth engine for both banks and credit unions.

Key Takeaways from This Blog:

CRM was pitched as the brain of modern banking. Instead, it became a bloated filing cabinet that is expensive, unloved, overfed with bad data, and...

Key Takeaways From This Blog: The Universal Banker is evolving into a digital, real-time advisor powered by AI, instant payment rails, and...