James White

James White is a seasoned financial services strategist with over 25 years of experience in banking technology, CRM, and fintech innovation. At EngageFI, he leads consulting engagements that help financial institutions modernize their strategies, deploy AI solutions, and drive growth through smarter engagement. James previously held executive roles at Raddon and Total Expert, where he built high-performing teams and helped banks and credit unions turn data into actionable strategy. His insights have been featured in The Financial Brand, American Banker, Credit Union Times, and BAI.

8 min read

M&A Study: 865 Banks and Credit Unions Are Ready to Merge, and Many Don't Know It Yet

By 2028, between 500 and 800 U.S. financial institutions will disappear. Not from failure. From the merger.

12 min read

The Consolidation Wave Banking and Credit Union Boards Are Ignoring

Key Takeaways from this Blog:

11 min read

The Charter Rush Nobody's Talking About

Key Takeaways from This Blog:

7 min read

The $298 Billion Lesson Banks Keep Ignoring

Key Takeaways from This Blog:

7 min read

The $10 Billion Question: Why Most Banks Are Sitting on a Data Gold Mine They Can't Spend

Key Takeaways from This Blog:

4 min read

AI-Native Banking Isn't Coming in 2026. It's Already Here.

Financial institutions keep talking about "adding AI" to their operations. Installing chatbots. Deploying fraud detection models. Automating...

3 min read

AI Isn’t One and Done: Banks Need an Agent Admin Before They Need Another Model

Key Takeaways From This Blog: AI isn’t static software, it learns, drifts, and changes over time. Treating it like a plug-and-play tool is a mistake....

3 min read

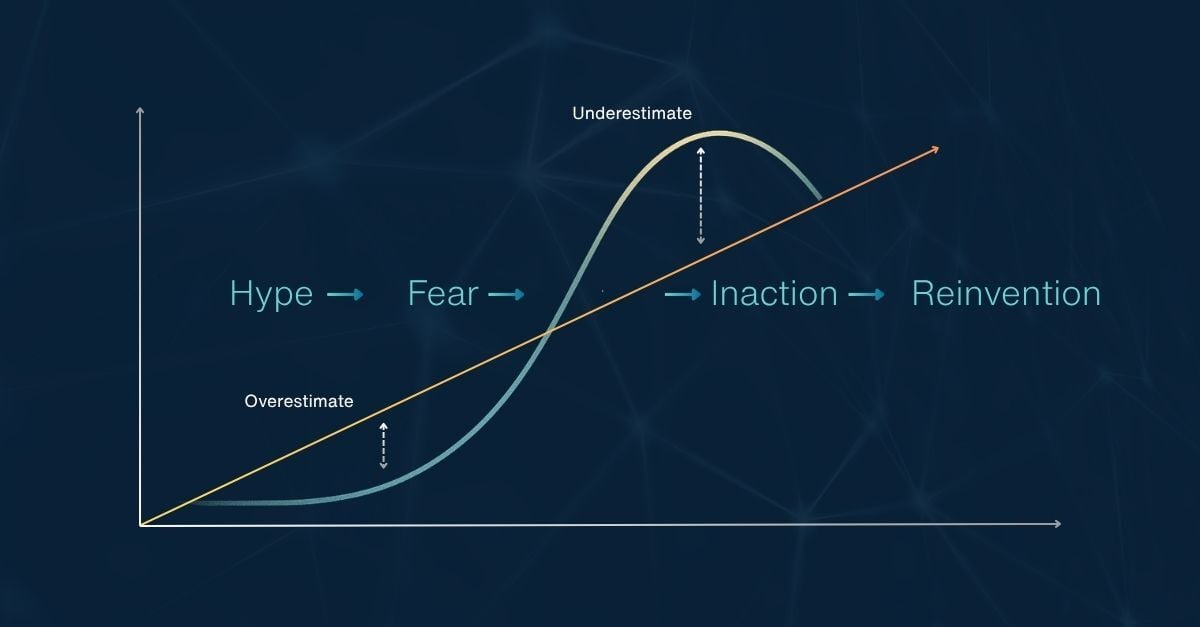

Amara’s Law and the Fear That Stalls Banking’s Future

Key Takeaways From This Blog: Each wave of innovation, online banking, mobile, now AI, follows the same cycle: hype, hesitation, and eventual...

1 min read

AI Agents Just Got a Wallet: What That Means for Banks and Credit Unions

Google, Mastercard, PayPal, American Express, and Coinbase quietly changed the script last week. They rolled out theAgent Payments Protocol, which...