Why Understanding the Generational Shift in Banking is Key to Remaining Competitive

The banking industry is experiencing a shift in how its customers conduct their financial business. When the last of the Baby Boomer generation makes...

Navigate this high stakes process with precision.

A solution delivering fast, efficient, and accurate core data.

Digital solutions to grow, scale, and outperform.

Reliable, efficient, and integrated core platforms deliver results.

Select modern communications channels to integrate with core and digital solutions.

Strategic Planning

Support services for the strategic planning process at every level.

M&A Planning

Realize the key value drivers resulting from your merger or acquisition.

Performance Benchmarking

Tailored metrics and benchmarks designed to assess relationships.

Organizational Efficiency

Enhance efficiency across branches, digital channels, and contact centers.

A digital library of industry news, analysis, best practices, and thought leadership tailored to the challenges and opportunities faced by financial institutions.

Our in-depth analysis of conversion strategies, M&A activity, and the evolving landscape of financial services.

A podcast channel for the time-constrained banking professional delivering sharp insights on fintech, strategy, and leadership to help you stay ahead in a fast-changing financial world.

For 360fi Workflow clients only. Sign in to access the workflow library and other guides, forms, and tutorials.

Key Takeaways From This Blog:

Every decade or so, banking learns the same lesson in a new way. We panic too early, then act too late.

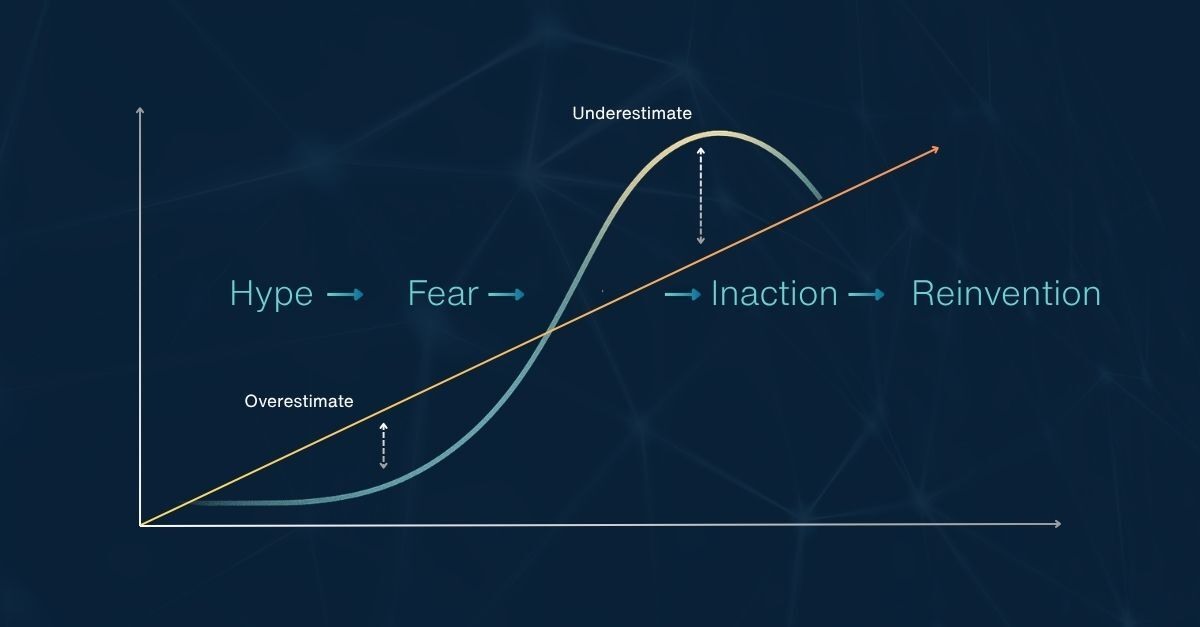

Amara’s Law predicted it long before anyone wrote a digital transformation strategy. We overestimate the effect of new technology in the short run and underestimate its impact in the long run.

That tension defines nearly every innovation moment in banking. Online banking. Mobile banking. Now, AI. The pattern repeats itself: initial frenzy, inflated expectations, budget cuts, disillusionment, and finally, quiet reinvention by the few who stayed the course.

Those few always share the same trait. They plan through fear.

The Short Run Always Feels Like Chaos

Executives remember the scars. The project that ballooned past its budget. The vendor that overpromised. The leadership retreat where transformation became a talking point instead of a roadmap.

So, when the next “big thing” arrives, fear masquerades as prudence. Committees stall. The next fiscal year arrives, and the cycle restarts.

But fear has an ROI of zero.

Institutions that win the long game do something different. They plan even when uncertain. They stay curious when others freeze. They make learning a measurable outcome.

The Real Risk Is Standing Still

Risk doesn’t live in new technology. It lives in old culture.

Most banks and credit unions were built for precision, not pace. Their DNA prizes stability, not adaptability. Yet the market rewards speed now. Consumers form loyalties in seconds, not years. Competitors pivot before policy can catch up.

Institutions that thrive create a rhythm of adaptation. They:

Agility is not chaos. It is structured curiosity. And it starts with a mindset that treats movement as progress, even when outcomes are still taking shape.

Fear Feeds on Silence

Walk through almost any boardroom right now, and the tone feels familiar. Everyone is cautious. Budgets are frozen. “Wait and see” has become a strategy.

That mindset is precisely why the next disruption always feels sudden. Fear fills the space where conversation should be. Planning is how you silence it.

Planning turns anxiety into alignment. It shifts the question from “What if it fails?” to “What do we learn if it does?”

Where We Are on the Curve

The industry sits squarely in Amara’s trough, the moment between overhype and underestimation. Generative AI, embedded finance, data-driven personalization, predictive engagement. Everyone talked about them last year. This year, most are waiting to see who moves first.

The winners already have. They are designing governance models for AI ethics. They are testing personalization frameworks that blend behavioral data with human context. They are learning faster than the fear spreads.

Amara’s Law is not a warning. It is a map. The curve always bends back toward impact.

Plan Early, Fear Less

Every executive faces the same fork in the road. Panic early or plan early.

The future rarely belongs to the boldest. It belongs to the most prepared. Those who view fear as an early signal instead of a stop sign. Those who treat transformation as an everyday discipline, not a crisis response.

Banking’s next chapter will not be written by the loudest voices on stage. It will be written by the quiet planners who understand that the long run starts now.

If your institution is afraid, good. That means you still see the wave forming. The only question left is whether you will ride it or wait for the next one.

.jpg)

The banking industry is experiencing a shift in how its customers conduct their financial business. When the last of the Baby Boomer generation makes...

The mixed bag of challenges and opportunities the economy presents in the second half of 2024 is quickly becoming a catalyst for action. Conducting a...

Key Takeaways from This Blog: