1 min read

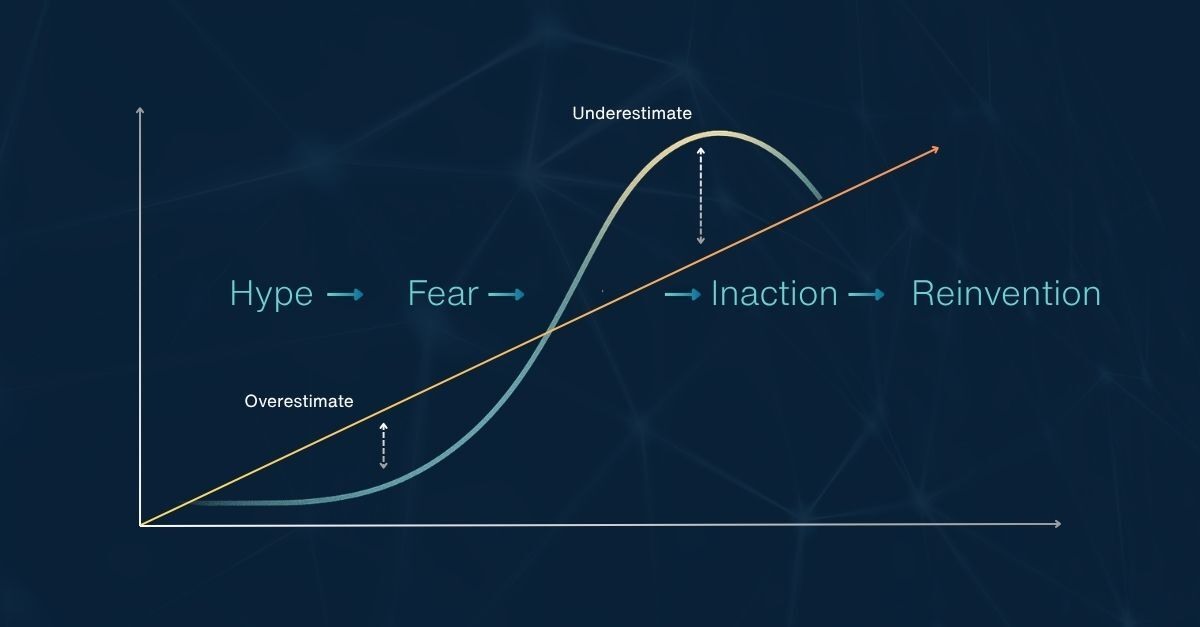

Amara’s Law and the Fear That Stalls Banking’s Future

Key Takeaways From This Blog: Each wave of innovation, online banking, mobile, now AI, follows the same cycle: hype, hesitation, and eventual...

Navigate this high stakes process with precision.

A solution delivering fast, efficient, and accurate core data.

Digital solutions to grow, scale, and outperform.

Reliable, efficient, and integrated core platforms deliver results.

Select modern communications channels to integrate with core and digital solutions.

Strategic Planning

Support services for the strategic planning process at every level.

M&A Planning

Realize the key value drivers resulting from your merger or acquisition.

Performance Benchmarking

Tailored metrics and benchmarks designed to assess relationships.

Organizational Efficiency

Enhance efficiency across branches, digital channels, and contact centers.

A digital library of industry news, analysis, best practices, and thought leadership tailored to the challenges and opportunities faced by financial institutions.

Our in-depth analysis of conversion strategies, M&A activity, and the evolving landscape of financial services.

A podcast channel for the time-constrained banking professional delivering sharp insights on fintech, strategy, and leadership to help you stay ahead in a fast-changing financial world.

For 360fi Workflow clients only. Sign in to access the workflow library and other guides, forms, and tutorials.

2 min read

Fabio Biasella

:

10/9/24 11:41 AM

Fabio Biasella

:

10/9/24 11:41 AM

.jpg)

The banking industry is experiencing a shift in how its customers conduct their financial business. When the last of the Baby Boomer generation makes its way into retirement, the focus must be on Millennials and Gen Z, two generations with markedly different banking expectations than their predecessor. As banks and credit unions face this market shift, they will have to continue to bridge the gap between traditional banking and innovation, while also providing an authentic customer or member experience that drives demand.

.jpg?width=1200&height=627&name=Generational%20Banking%20(1).jpg)

Boomers are the largest (and wealthiest) generation in history and their savings and spending habits are considered growth drivers at banks and credit unions. Understandably, financial institutions have catered to the needs of their largest constituents. Now, however, Millennials are hitting their prime consumption era and Gen Z is just beginning its foray into the financial landscape.

Today, Millennials and Gen Z face significant financial challenges that are shaping their banking preferences and financial behaviors and setting them apart from Baby Boomers. The younger generations are carrying an unprecedented amount of debt, exceeding $1T. This massive debt load is having an impact on their financial decisions and outlook. Despite being highly educated and having high rates of participation in retirement savings plans like 401(k)s, only 35.8% of Millennials report feeling financially secure. * This lack of confidence is likely due to their substantial debt burden and other economic pressures. Interestingly, Millennials are currently saving more than both their older and younger counterparts. This could be a response to their financial insecurity and a desire to build a safety net.

Like their Millennial counterparts, Gen Z has grown up around technology and economic uncertainty. However, this generation tends to be more fiscally conservative when compared to Millennials. They prioritize both financial security and saving over spending. Gen Z also shows a propensity for investment tools and cryptocurrencies that are not typically part of a Millennial’s financial strategy.

In today’s digital age, banking preferences among Millennials and Gen Z centers around online solutions. That said, they will be the first to admit when faced with a problem, their preference is for immediate human contact to resolve their issue(s). Both generations value a seamless mobile banking experience and favor the products and services tailored to their special circumstances. They are unafraid to use multiple institutions for different product solutions, including smaller or lesser-known fintechs and digital-only banks. Lastly, they seek to do business with institutions that align with their core values and appreciate financial advice and tools to help them better navigate a world of economic uncertainty.

The needs and preferences of each generation make it challenging for financial institutions to deliver an exceptional experience. As banks and credit unions navigate the complexities of servicing vastly different demographic segments, they must also deliver a balance between traditional and online banking, without creating alienation among their customers and members. Implementing innovative technology is both costly and a drain on resources and the regulatory and compliance challenges associated with modern technology add another layer to the growing list of demands.

Despite these challenges, the opportunities far outweigh them, particularly given the debt burden younger generations face. Banks and credit unions are uniquely positioned to serve as trusted resources, providing the education and guidance needed to navigate today’s financial challenges. To further capture loyalty, financial institutions must adopt strategies that go beyond traditional offerings. Leveraging data analytics to deliver tailored financial products, enhancing digital onboarding process to ensure an exceptional experience, and embracing innovation that focuses on the unique needs of younger demographics will help build long lasting relationships.

Understanding and adapting to the generational shift is crucial for banks and credit unions striving to remain competitive. As Baby Boomers retire, and Millennials and Gen Z emerge as dominant forces in the market, financial institutions must innovate their strategies to not only meet the unique needs of each group, but to survive. By incorporating this generational shift into their strategic plans, banks and credit unions can enhance their customer/member engagement, drive growth, and ensure long-term success.

1 min read

Key Takeaways From This Blog: Each wave of innovation, online banking, mobile, now AI, follows the same cycle: hype, hesitation, and eventual...

The mixed bag of challenges and opportunities the economy presents in the second half of 2024 is quickly becoming a catalyst for action. Conducting a...

Key Takeaways from this Blog: