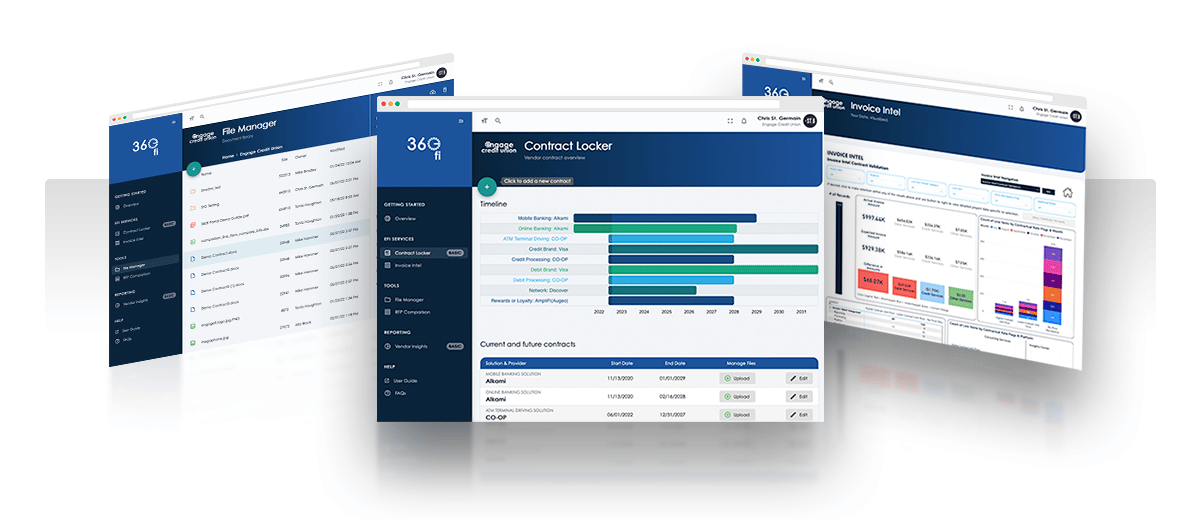

Engage fi Announces New Community Financial Institution Portal

360fi Merges Proven Industry Data and Insights with Innovative Technology Automation to Enable Financial Institutions to Make More Informed Business...

If you’re considering or are about to enter a digital transformation it’s no news to you there are many pieces to the puzzle to consider. In this article, we’ll review how your financial institution can come to a common understanding of what a digital transformation is, why now is the time to act, and the six digital transformation trends Engage fi is seeing across clients and projects.

The word “digital” can mean so many different things these days. When asked, financial leaders define “digital” in a variety of ways.

Your online/mobile banking platform and vendor can become a launching pad or frustrating barrier for how you conduct a digital business. It’s truly, just one piece of the overall puzzle, but it is an important one. It’s the most common touch point you have with your member. But that’s not all. It’s a user-facing portal that integrates with many of your other systems – including cards, mortgages, account opening, loan origination, etc. The flexibility, integrations and user experience created by your digital banking platform affect the user experiences your custommers have with those services as well.

Before selecting a new digital banking vendor, we recommend that financial institutions set a corporate digital vision and be ready to answer tough questions about your commitment to achieving that vision. Without doing so, the voice of the current culture can limit your transformation.

According to the Digital Banking Report, when financial leaders were asked about their top three priorities for 2023, 77% selected: “Improve digital experience for consumers.” The next priority at 45% was the “Enhance data and analytics capabilities.” Third was 29% saying “Reduce operating costs.”

It’s probably not a surprise to you that the percentages haven’t changed drastically over the past few years. Financial institutions have spent the last several years talking about digital transformation – painting a picture of where we need to go to meet consumer expectations. We want to:

Expanding digital products and payment capabilities are top of mind for many. Solid online and mobile banking platforms are among the most effective customer retention tools. 91% of account holders mention their bank’s digital banking offerings as a key factor in choosing where to bank, and 82% of customers won’t switch banks because of the online banking platform. Most competitive financial institutions offer their customers mobile banking – the ability to complete financial transactions via their smartphone or tablet – and many additional features. In order to keep up with the ever-growing demands of digitally-savvy consumers, both digital and legacy institutions must continue adapting to mobile market trends to remain relevant.

But that doesn’t necessarily mean you’re meeting users’ expectations. In fact, according to the 2023 BAI Banking Outlook, only 4% of financial services leaders reported delivering an excellent digital user experience, and 44% claimed to deliver an average experience. Furthermore, more than 55% of those surveyed said they would be willing to switch institutions for a better mobile app and digital capabilities.

Still not convinced? Here’s why NOW is the time to act. According to a report from Insider Intelligence, 89% of U.S. respondents say they use mobile banking channels, and 70% say mobile banking has become the primary way to access their accounts. If you aren’t keeping up and don’t update your technology, consumers will bank elsewhere.

As we look at the digital banking space, we’re seeing some common trends.

Creating a frictionless journey can lead to better experiences for users across all digital channels and can lead to potential operational efficiencies. It is important to prioritize user experience during their digital transformation, ensuring the solutions meet all needs in terms of convenience, security, comfort, and engagement. Personalization is becoming increasingly important, especially with more than 180 million millennial and Gen Z individuals in the U.S., accounting for 55% of the U.S. population preferring a personalized experience from their financial institution. Nearly three-quarters of consumers are willing to share their data to receive personalized customer benefits.

Financial institutions on legacy systems can see their user adoption and engagement is lacking and are demanding improved user experiences to meet user expectations. In the past, decisions might have been driven more by vendor price, but financial institutions are willing to pay more now because of the indirect value of a better experience.

When we start an evaluation project, we spend time with executives and operational teams to understand their requirements and goals. Often clients are looking for the presence of a Software Development Kit (SDK), an Application Programming Interface (API) and a partner culture that allows for customization, but many clients today aren’t equipped with the development staff to immediately act on these requirements.

If the groundwork hasn’t been laid with a corporate, strategic digital plan, it’s not uncommon for the purchase of an SDK to be pushed to a second phase priority or for current culture and staffing limitations to eliminate vendors that require more configuration or development because organizations aren’t ready to commit to making the needed changes.

Integration is one of the key factors that financial institutions consider when evaluating vendors. Again, digital banking is a portal that touches many other systems, and the depth and type of integration strongly impact the digital experience. Consolidating offerings into one system has a positive affect on the financial institution and the consumer. Users have the ability to perform all banking tasks in one location and appreciate the ease of not navigating to multiple places or additional logins. A seamless digital banking platform lends to a seamless user experience.

As we saw earlier, enhancing data and analytics capabilities is the #2 priority of financial leaders in 2023. As Engage fi works with clients on vendor evaluations, we hear it’s a priority too, but most tend to say they don’t have a data warehouse or data lake yet, but that it’s a strategic initiative on their roadmap. Vendors have noticed this as well. In some cases, they have built their own data engines that help bridge the gap.

The digital experience for customers includes every effort financial institutions put into the pathways of their digital journey to increase customer satisfaction. The digital journey includes all of all the interactions that customers have along their entire usage journey, such as: login, transferring money, confirming transactions, and receiving notifications. Incentives financial institutions can offer to draw consumers in include a simplified account opening experience, data security, effortless accessibility, and personalization.

If you haven’t already, it’s time to update your digital banking technology to be more flexible and capable of supporting innovation. Perhaps this is already what keeps you up at night, and you can relate to one or more of the above 6 Digital Transformation Trends. Here are some final thoughts to consider when going through a digital evaluation:

360fi Merges Proven Industry Data and Insights with Innovative Technology Automation to Enable Financial Institutions to Make More Informed Business...

Why did you enlist us for help? Community Choice is a $1B asset credit union headquartered in Michigan with an eye on growth and providing an...

By Greg Ryan